Table of Contents

Is VAT Applicable on Cancellations and No-Shows?

The UK government implemented a new VAT policy on March 1, 2019, affecting non-refundable deposits for cancelled or missed bookings. This unexpected change impacted many short-term rental managers’ tax accounting and revenue-related calculations.

Brexit has made the Tour Operators’ Margin Scheme (TOMS) no longer applicable in the UK. TOMS previously allowed tour operators to zero-rate certain supplies. For more information on the impact of Brexit on TOMS, please refer to the UK government website.

How Have We Dealt with Non-refundable Deposits Up until Now?

As of September 2024, UK vacation rental managers must be aware of the following VAT regulations:

- Non-refundable Deposits: VAT is generally due on non-refundable deposits, even if the guest doesn’t use the services.

- Cancellation Fees: VAT may or may not apply to cancellation fees, depending on the circumstances. Consult HMRC guidance for specifics.

- No-Show Charges: No-show charges are typically subject to VAT.

Key Actions:

- Review Policies: Ensure your cancellation and no-show policies are up-to-date and reflect the VAT implications.

- Seek Professional Advice: Consult with a tax professional for guidance tailored to your business.

- Stay Informed: Regularly check HMRC’s website for any changes in VAT regulations.

By understanding and adhering to these guidelines, you can effectively manage VAT on cancellations and no-shows in your UK vacation rental business.

How Should We Handle Cancelled Bookings and No-Shows Moving Forward?

The UK government introduced a new VAT policy, requiring vacation rental managers to pay VAT on non-refundable deposits for cancelled or no-show bookings.

This significant change has impacted the financial operations of the hospitality industry. To avoid penalties and maintain compliance, review your policies, seek expert advice, and stay updated on VAT changes.

To effectively manage VAT-related obligations and ensure tax compliance, UK vacation rental businesses should understand and follow these guidelines.

How Does VAT on Cancellations and No-Shows Affect My Vacation Rental Business Operations?

To comply with the UK government’s VAT policy, Most noteworthy, if you have not considered this new VAT policy, be sure to take it into account in your business plan.

1. First, review your cancellation and no-show policy, and check its terms and conditions.

2. Also, ask your accountant or VAT counsellor for advice on how to change your accounting procedures accordingly. You will most probably need to include non-refundable invoices from cancelled bookings in your accounting system or software.

How Can I Minimise the Disruption in My Business?

Each time you face a new VAT policy, you need to review the way you operate your vacation rental business. Your accounting tasks will become more complex because of the HMRC’s new VAT policy on non-refundable deposits. From now on, you will have to include the invoices for those types of bookings in your VAT declaration.

Luckily, there are solutions available. Online accounting software like Xero can streamline the time-consuming process of creating invoices.

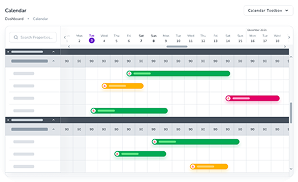

You find it probably even more advantageous to entrust the operation of your short-term rentals. You need an all-in-one channel manager. A channel which integrates with an online accounting platform to make your tax life hassle-free.

Zeevou is a user-friendly online platform designed to streamline hospitality management. Automatically generate professional-looking draft invoices for all bookings, even for cancelled or no-show bookings. This can simplify your accounting tasks and help ensure compliance with VAT regulations. Zeevou can also integrate with popular accounting software, making it easier to manage your finances. To learn more about how Zeevou can benefit your vacation rental business, please click here.