Rules and regulations of running a vacation rental business vary depending on your location. Airbnb recommends its hosts to “understand the laws in your city, county, state, province, territory and/or country (your jurisdiction).”

Vacation rental rules and regulations affect your business, for no doubt. Vrbo shows some examples of the type of regulations that could directly impact how you rent your property:

1. Nuisance issues prevent homes from operating as a short-term rental that disrupts the neighbourhood.

2. Occupancy limits the number of occupants to prevent threatening the safety of the occupants and home.

3. Registration requirements remind us of the importance of the registration process in the area our home is located.

4. Tax collection: rental owners may need to pay taxes on their rental income in addition to property taxes.

Table of Contents

Types of Vacation Rental Rules and Regulations

In this blog, we’ll introduce you to different types of regulations you need to consider before starting your vacation rental business. To expand on the regulation types, we go through Airbnb’s recommendations at “What regulations apply to my city?” We’ve added to each section links and information on different locations. However, the list might not be exhaustive, and you need to check the accuracy of the information below with the laws in your area.

Do You Need a Business License to Start a Vacation Rental Business?

Check with your local jurisdiction if you need a business license before operating your vacation rental business. Whether you rent out a room or your entire home, you’re still required to get a business license in most places. While searching for a business license, you may need to google Transient Occupancy Tax (TOT) or Land Use Permit on your city website.

How to Comply with Building Standards on Habitability, Health, and Safety

You need to comply with a list of building standards and safety regulations to get a license to run your vacation rental business. In some cities, jurisdictions require an inspection session report to grant a vacation rental permit. The accreditation process in the UK can be processed with Short Term Accommodation Association (STAA). The annual accreditation is awarded after taking the necessary steps.

How Zoning Rules and Restrictions Can Affect Your Vacation Rental Business

Zoning rules set out the way you can use your property/home. According to zoning restrictions, you might not be able to use your property as a vacation rental! These rules are set to prevent any disturbance for the people of that area.

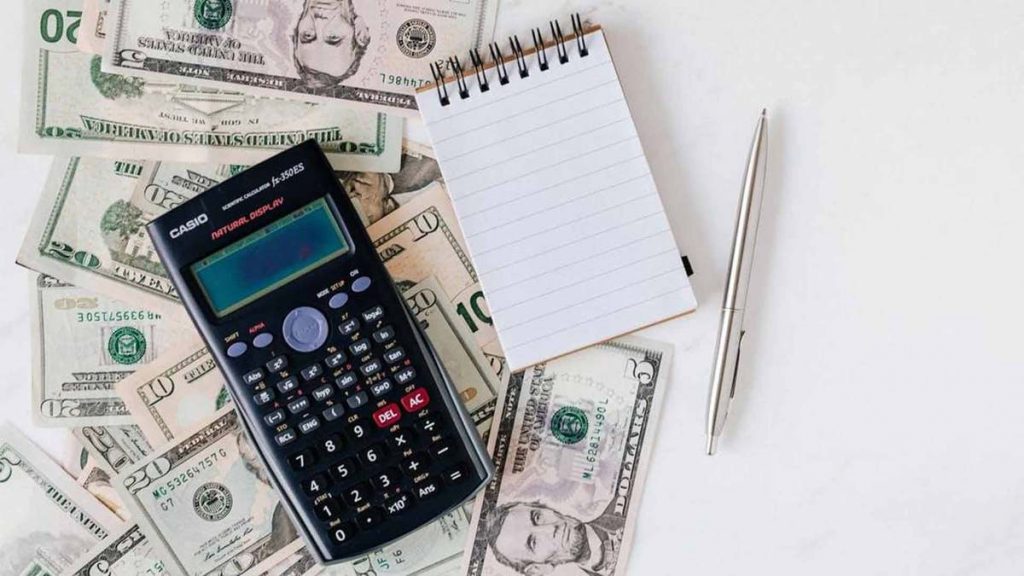

Tax Considerations for Vacation Rental Managers

If you own a vacation rental, you may need to pay:

Tax for the Property

You need to pay tax for your property according to your usage of it over the year. It means that if you use it as a vacation rental and some days for personal use, you will pay different taxes compared to using it as your home.

Tax for Each Overnight Stay

You will be required to collect a tax for an overnight stay. In some areas, Airbnb collects local taxes on behalf of the hosts. In what areas is occupancy tax collection and remittance by Airbnb available? Read more here.

Tax for Income and Expenses

This tax belongs to your income when you have deducted the expenses from it. The “income” is the total amount you collected from rent, cancellation fees, and the security deposit that you have not returned. The “expenses” vary from cleaning fees to utilities and marketing. You need to ask for the details of income and expenses from your local jurisdiction.

In the US, the 14-day rule may cause an exception for you to pay tax. According to Turbotax, you don’t pay tax on income you earn from the short-term rental, as long as you:

– rent the property for no more than 14 days during the year AND

– use the vacation house yourself 14 days or more during the year or at least 10% of the total days you rent it to others.

If you have questions about vacation rentals’ taxation in the US, you might find this overview helpful. Ernst and Young’s United States “General guidance on the taxation of rental income” (English) gives you an overview of tax return forms for income tax only.

Tax regulations are the most complicated of the rules that vary from one place to another.

What Is the Importance of Landlord-Tenant Laws?

In some locations, the law recognises the guest as a tenant if she or he stays more than a specific period. It will cause difficulties in removing the guest as the rights of tenants will protect them.

What Are Some Rules and Regulations of Rental Houses?

Rules and regulations for rental houses vary depending on the country, state, and local jurisdiction. However, here are some common rules and regulations that may apply:

Rental Agreements:

Similar to long-term rentals, vacation rentals often require a rental agreement that outlines the terms and conditions of the rental, including the length of stay, rental rates, cancellation policies, and any restrictions or house rules.

Occupancy Limits:

Vacation rental properties typically have occupancy limits to ensure guest safety and compliance with local regulations. These limits specify the maximum number of guests allowed to stay in the property.

Noise and Nuisance:

Vacation rentals often have rules regarding noise levels and disturbances to ensure a peaceful environment for both guests and neighbours. Guests are expected to be considerate and avoid excessive noise that may disturb others.

Check-In and Check-Out Procedures:

Clear instructions and guidelines should be provided to guests regarding check-in and check-out procedures, including key exchange, property access, and any specific requirements for returning the property in the same condition as upon arrival.

Safety and Security:

Vacation rentals should meet safety standards, including having functioning smoke detectors, fire extinguishers, and emergency contact information for guests. It may also be necessary to comply with local safety regulations such as pool safety or childproofing requirements.

Maintenance and Damage:

Guests are typically responsible for taking care of the property during their stay and reporting any damages or maintenance issues promptly. The rental agreement should specify the guest’s liability for any damages caused during their stay.

Cleaning and Housekeeping:

Clear expectations should be set regarding cleaning responsibilities, whether it’s the guest’s responsibility to clean the property before departure or if professional cleaning services are provided.

Security Deposit:

A refundable amount paid by the tenant at the beginning of the lease to cover any potential damages or unpaid rent. The conditions for refunding the security deposit should be clearly defined in the lease agreement.

Pet Policy:

If pets are allowed in the vacation rental, there may be specific rules and restrictions regarding pet types, sizes, and additional fees or deposits for bringing pets.

It’s important for vacation rental hosts to familiarise themselves with the specific rules and regulations that apply to their location. Consulting local authorities, vacation rental associations, or legal professionals can provide further guidance on complying with the specific regulations in your area.

Smoking Policy:

Rental properties may have rules regarding smoking, including whether smoking is allowed inside the premises or restricted to designated areas.

Vacation Rental Rules and Regulations – Conclusion

Although OTAs facilitate vacation rental management as a starting point for making money by renting out the spare room of your house, there are many regulations that you need to follow to get a permit for operating your vacation rental. Even after getting all the licenses, your short-term rental requires constant control for tax payments and other payments in the form of business licenses’ extensions.

You need to get help from your local jurisdictions to ensure you have not missed any of the steps. As an example, Keycafe blog provides a comprehensive overview of Amsterdam’s short-term rental regulations.