In December 2020, Airbnb went public, making it a hot topic in the stock market during the COVID-19 era. As the CEO of Airbnb, Brian Chesky, stated in an interview with CNBC, an IPO was a natural step for the company. He also said that it would allow them to tell their story to a wider audience. According to Transparent, the short-term rental industry could no longer be ignored as Airbnb reached the IPO milestone.

However, before investing in Airbnb shares, it’s important to consider the following questions:

- What does it mean for a company like Airbnb to go public?

- Which symbol does Airbnb trade on?

- Is investing in Airbnb stock a good decision?

If you’re interested in learning more about Airbnb IPO, read on for key facts about the Airbnb ticker symbol and IPO process.

Table of Contents

What Is an IPO?

An IPO, or Initial Public Offering, is a significant event for a private company. It marks the first time the company’s shares are offered to the public for purchase. This process enables the company to raise capital by issuing shares to the public. The proceeds from the sale of the shares go to the company. So, they can use it to fund growth, pay off debt, or acquire other companies. In order to hold an IPO, companies must meet the requirements set by the Securities and Exchange Commission (SEC). These requirements include financial reporting, governance, and other compliance measures. Companies typically go public when they have reached a private valuation of around $1 billion and have satisfied the SEC’s requirements.

When Did Airbnb Go Public?

The company initially announced its plans to go public in September 2019. The Conversation reported that, on December 10th, 2020, Airbnb successfully completed its initial public offering. It began trading on the Nasdaq stock exchange under the ticker symbol ABNB. The offering was one of the most highly anticipated of the year. Many investors were eager to get a piece of the fast-growing home-sharing platform. The company raised $3.5 billion in its IPO, valuing the company at $47 billion and making it one of the largest IPOs of 2020.

Why Did Airbnb Go Public?

Airbnb CEO Brian Chesky noted that the main reason for going public was to share the company’s story with as many people as possible. However, there are other reasons as well. One of the main reasons for going public is to raise capital for growth and expansion by selling shares of stock to the public. Additionally, going public can increase a company’s visibility and credibility with investors, helping to attract more investment in the future.

In 2020, Airbnb management decided to go public to control potential damage to the company’s value due to slowing growth. According to SEC filings, Airbnb’s goal was to raise additional capital to fund future growth. This strategy brings in fresh cash and increases the company’s value with the help of public investors.

Another reason is that it provides liquidity to the early founders of Airbnb. Before going public, shares are usually only available to a limited group of people like employees and early investors. Going public allows these shareholders to sell their shares in the open market, which can be beneficial if they need to cash out.

According to Investopedia, some advantages of an IPO include:

- Access to investment from the entire public to raise capital.

- Facilitation of easier acquisition deals and increase in company exposure, prestige, and public image, which can boost sales and profits.

- Required quarterly reporting leads to increased transparency, which can result in more favourable credit borrowing terms for the company.

Additionally, going public brings increased scrutiny and pressure. It helps management teams focus on sustainable growth and profitability. It also gives the company a currency for acquisitions and can help attract and retain top talent.

What Was the Price of Airbnb IPO?

The initial price range for the Airbnb IPO on Nasdaq, under the ticker symbol ABNB, was $45-$50 per share during the pre-marketing phase. This later increased to $55-$60, and the IPO price was $68 per share on the day of trading. The company sold 51 million shares in the IPO, raising $3.5 billion in the process.

The $68 per share price was determined by the company and its underwriters (the investment banks) during the IPO process. The price was determined through book-building, a process to gauge demand for the stock and set the price. The underwriters and the company considered various factors, such as the company’s financial performance, market conditions, and investor demand for the stock before determining the final price.

As mentioned above, the $68 per share price was above the expected range of $44 to $50 per share. The stock price increased 140% at the end of the first day, indicating high demand and oversubscription of the stock. When the price reached $144.71 per share, Airbnb had a public market capitalisation of $86.5 billion, surpassing the market capitalisations of Booking.com and Expedia. The New York Times reported that Airbnb was valued at $100 billion when it went public.

Is Airbnb Stock a Good Investment?

In the travel industry, Airbnb is a major player. Despite the impact of COVID-19 on the hospitality industry, Airbnb has remained in a relatively strong position. This can be attributed to several factors, such as being a tech-based rental company that supports the “belonging anywhere” motto, which aligns with the new trend of working from home. Additionally, Airbnb has built a strong brand that has earned the trust of its customers.

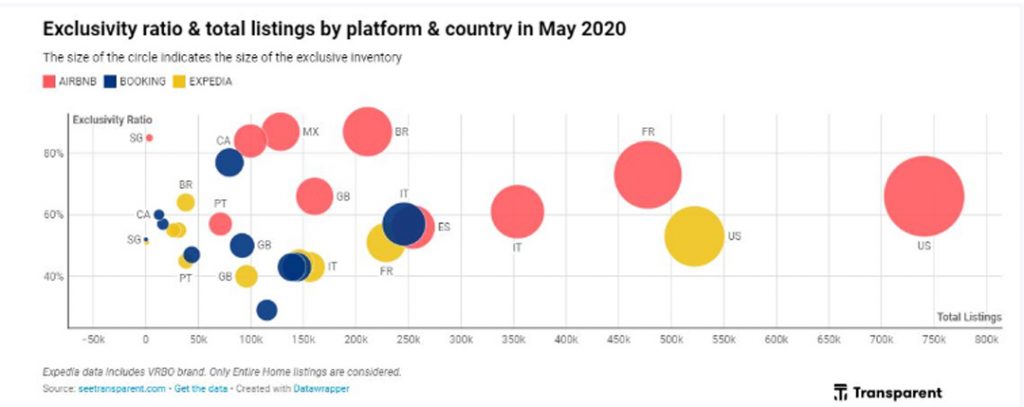

According to Transparent data, guests preferred Airbnb over its competitors and travelled with Airbnb more frequently in 2020. In September 2020, Airbnb represented 68% of bookings among the top 3 OTAs, with 33% going to exclusive Airbnb listings. The closest competition, Booking.com, accounted for 25% of total bookings.

Airbnb’s dominance in the market makes its IPO a potentially profitable investment.

However, some people believe that investing in Airbnb IPO may not be wise, with some suggesting that the company went public to compensate for the impact of COVID-19.

But, it is important to note that the short-term rental market is expected to grow in the future. According to a report by Research And Markets, “The vacation rental market is poised to grow by $84.41 bn during 2023-2027, accelerating at a CAGR of 8.54% during the forecast period.” This is driven by the increasing popularity of online platforms, such as Airbnb, and the growing trend of experiential travel. Therefore, investing in Airbnb IPO may be wise for those looking for long-term growth potential in the travel industry.

A temporary stock price drop after an IPO is normal. Additionally, investing carries risks, and past performance is not a guarantee of future results. Thus, investors should do research and consider their own risk tolerance before investing in any stock, including Airbnb IPO.

Airbnb Hosts

According to CNBC, Airbnb set aside about 9.2 million nonvoting shares for hosts through the Host Endowment Fund. This is intended to be a long-term investment in the future of the host community, shaped by hosts for hosts. Airbnb also sent out emails to some of its hosts to register them for the Directed Share Programme.

In conclusion, investing in Airbnb shares during the COVID-19 era was a hot topic and is still relevant today. While the profitability of Airbnb IPO is a time-sensitive topic, it is still worth considering as an investment opportunity.

Have you bought any Airbnb shares yet? What do you think is the reason behind Airbnb going public? Let us know in the comments.