Why put all your eggs in one basket? Diversify your portfolio by exploring the best places to invest in vacation rentals across Europe. Investing in overseas vacation properties can significantly boost your portfolio and maximise returns in the current market.

Purchasing an overseas vacation rental can feel daunting, but the potential rewards in 2025 are substantial. Not all countries offer the same benefits, so it’s essential for savvy investors to choose wisely based on specific needs and market trends.

As a savvy investor, avoid focusing solely on one area. Diversify your efforts by considering these top European destinations for vacation rental investments in 2025.

Table of Contents

Key Factors in Selecting a Vacation Rental Investment Location

When considering where to buy a vacation rental in Europe, several critical factors should guide your decision-making process for optimal ROI in 2025.

Tourism Trends and Vacation Rental Investments

Dive deep into current tourist demographics and evolving travel patterns. Look for destinations with consistent tourist inflow throughout the year, not just seasonal peaks. Places offering diverse experiences—think pristine beaches, majestic mountains, and rich cultural attractions—tend to attract a wider range of visitors, significantly boosting occupancy rates and rental income.

Seasonal Crowds

Opt for a destination that manages tourist flow effectively, even during peak seasons. This balance ensures your property remains appealing without becoming overwhelmingly crowded for guests, maintaining a positive experience and encouraging repeat bookings.

Natural Disasters and European Vacation Rentals

Protect your investment by avoiding areas historically prone to natural disasters like severe floods, wildfires, or extreme storms. Minimising these risks safeguards your property and ensures the safety and comfort of your guests, reducing potential disruption and costly repairs.

Year-Round Appeal

Choose a property in a location that offers appeal and accessibility all year round. Proximity to reliable public transportation, essential amenities, and popular attractions is crucial. Investigate the availability of local events and activities, especially during the off-season, to maintain a steady stream of visitors and maximise your rental potential.

Regulatory Landscape and Vacation Rental Investments

Not all sunshine and roses! A thorough understanding of local short-term rental regulations is paramount. Some European cities have strict restrictions on short-term rentals, which can significantly impact potential income and guest limitations. Be wary of areas with overly complex or frequently changing regulations, or those demonstrating a growing trend of restrictions against short-term rentals.

Rental Market Performance

Numbers talk! Analyse key metrics like historical occupancy rates and average daily rates (ADR) to accurately gauge potential return on investment (ROI). Tools like AirDNA and similar analytics platforms can provide invaluable data on rental income projections specific to 2025 trends.

Look for healthy historical occupancy rates. While overall European averages might vary (around 55-60% in many regions as of 2025), ideally, aim for properties demonstrating above 65% occupancy for truly strong performance, especially in prime locations. Combine this with average daily rates (ADRs) that clearly justify your investment.

Tax Considerations for European Vacation Rentals

Tax implications for vacation rentals can differ significantly across Europe. VAT rates, tax residency rules, and potential deductions all play a crucial role in your overall profitability. Consulting with a tax advisor deeply familiar with the specific tax regime of your chosen country is highly recommended to optimise your tax strategy for 2025. For a more in-depth exploration of tax implications, consult with a professional tax advisor specialising in European real estate investment.

Political Risks

Political instability, sudden policy changes, and economic shifts can all significantly impact the success of your vacation rental investment. Research the country’s current political climate, its history of stability, and its economic outlook for 2025. Look for a country with established and predictable regulations for short-term rentals and a demonstrably supportive stance towards tourism investment.

Pricing Issues and Your European Vacation Rental

Striking the right balance with your pricing is key to maximising revenue. A price that’s too high might lead to prolonged vacancies, while a price that’s too low could leave significant money on the table. Explore the concept of dynamic pricing, which intelligently adjusts rates based on real-time demand, seasonality, and local events. Popular vacation rental platforms like Airbnb often have built-in dynamic pricing tools that can help you maximise your income during peak seasons and attract bookings during slower periods.

Management Considerations

Be honest about your bandwidth and preferred involvement in property management. If a hands-off approach is preferred, consider professional property management services. There are also cost-effective marketing options available, including online booking websites and property management systems (PMSes) that streamline operations and enhance guest experience.

Top Countries for Vacation Rental Investment:

Based on current trends, projected tourism growth, and investor appeal, these European destinations stand out for vacation rental investments in 2025.

1. Portugal (The Azores)

A volcanic island chain west of mainland Portugal, the Azores boasts stunning natural beauty and a strong focus on sustainable tourism, attracting adventure travelers and nature enthusiasts. This leads to consistently healthy occupancy rates, averaging around 64% [AirDNA, 2025] for the region. While Portugal’s main Golden Visa route via real estate is no longer available in 2025, the Azores’ natural appeal continues to draw visitors and offers promising holiday rental potential.

2. Greece (Corfu)

Corfu remains a classic Greek island getaway with a rich cultural heritage, stunning beaches, and vibrant nightlife. It has a long-established history of tourism, with consistent and growing demand from international visitors, leading to high occupancy rates and stable rental yields, making it a reliable investment in 2025.

3. Spain (Seville)

Seville, the captivating capital of Andalusia in southern Spain, offers a compelling blend of Andalusian charm, profound historical significance, and vibrant culture. It’s a popular year-round destination with a well-established tourist infrastructure and a continuously expanding short-term rental market, indicating strong growth potential.

4. France

France is a perennial favourite with tourists, thanks to its romantic cities, charming villages, and stunning countryside. While specific locations require deeper research, overall France offers a stable economy, a well-developed tourist industry, and a variety of vacation rental investment opportunities.

5. Italy

Similar to France, Italy provides a vast array of investment possibilities, from iconic cities like Venice and Florence to historical treasures like Rome, and the serene beauty of the Italian lakes and coastlines. The country boasts a robust tourism industry and numerous areas with consistent and high rental demand, promising steady returns.

6. Germany (Berlin)

Berlin, the dynamic capital of Germany, is a sophisticated city with a continuously growing economy, a burgeoning tech sector, and a large, young population. This demographic fuels strong demand for rental properties, making it an attractive option for investors and one of the best places to invest in urban vacation rentals.

7. Ireland (Dublin)

Dublin, the capital of Ireland, is a vibrant city characterised by its strong tech sector, thriving startup scene, and growing population. This fuels significant demand for rental properties, particularly modern apartments and short-term corporate lets. Additionally, Ireland offers a favorable corporate tax rate for certain businesses, which continues to attract foreign investors.

8. Poland (Krakow)

Kraków, a historic city in southern Poland, continues to be a highly popular tourist destination known for its medieval architecture, rich history, and vibrant cultural attractions. With a lower cost of entry compared to many Western European destinations, Kraków offers significant potential for attractive rental yields and capital appreciation in 2025.

9. Netherlands (Amsterdam)

Amsterdam, the capital of the Netherlands, remains a top-tier tourist destination renowned for its picturesque canals, world-class museums, and liberal culture. Despite some evolving regulations, the city has a well-established holiday rental market and a consistently high demand for rental housing due to its growing population and global appeal.

10. Austria (Vienna)

Vienna, the capital of Austria, is celebrated globally for its imperial palaces, legendary classical music scene, and consistently high quality of life. The city benefits from a stable economy, a highly developed and resilient tourist industry, and strong demand for investing in vacation rental properties, offering a secure and profitable outlook.

Multiple-location Property Management System

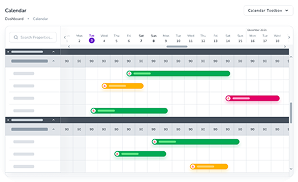

A multiple-location property management system (PMS) is an indispensable tool for managing properties across different geographical locations from a single, unified login.

Unlike a regular PMS that often requires separate accounts for each location, which can be time-consuming and inefficient, a multiple-location property management system allows you to group properties logically by country, city, and even specific area. This streamlined organisation significantly simplifies the management of diverse units and various unit types within your portfolio.

Furthermore, a sophisticated multi-location PMS enables flexibility in how you rent out a property, allowing options for renting as a separate room or as an entire house. You can also easily set different currencies for properties in various countries and operate seamlessly across multiple international markets. Crucially, your property management system with multiple locations should include robust calendar syncing. This vital feature allows you to view all vacancies and occupancies across your entire portfolio in one intuitive calendar, providing a comprehensive overview for optimal booking management.

Ready to streamline your global vacation rental portfolio? Zeevou’s award-winning multi-location PMS is designed to simplify management, maximize bookings, and scale your business with ease. Discover how Zeevou can transform your operations today!

![The Best Places in Europe to Invest in Vacation Rentals [2025]](https://zeevou.com/wp-content/uploads/2024/06/Feature-Image_The-Best-Places-in-Europe-to-Invest-in-Vacation-Rentals-2025-1024x538.jpg)