Vacation Rental Expense Tracking

Ensure all expenses of your multi properties are accounted for and matched up with the correct unit with Zeevou’s vacation rental expense tracking.

Tailor Every Expense, Enhance Your Reports

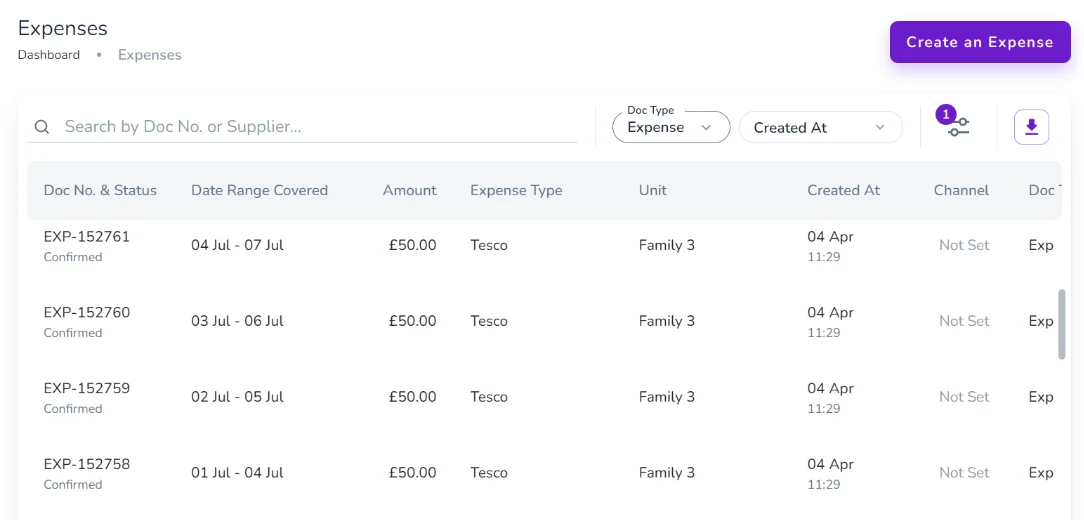

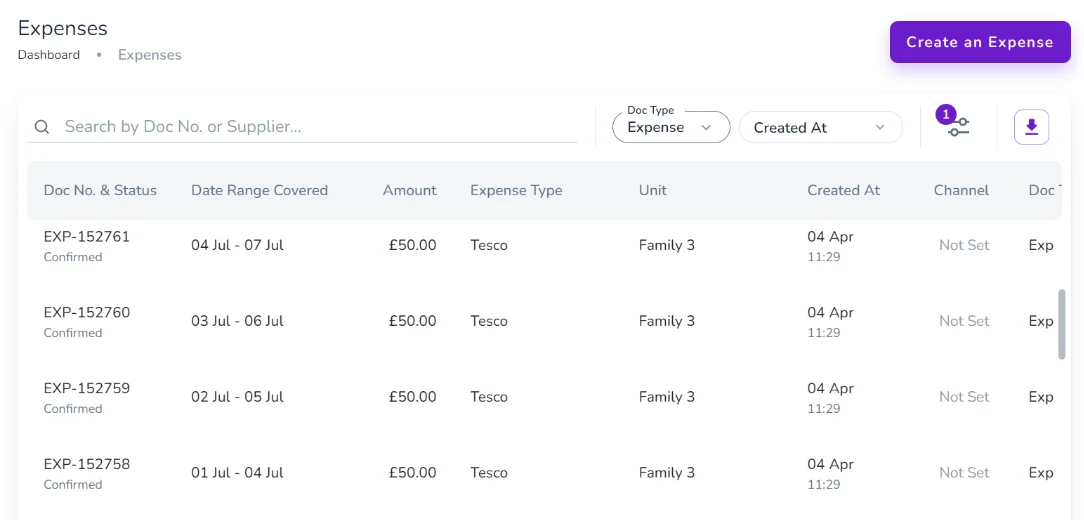

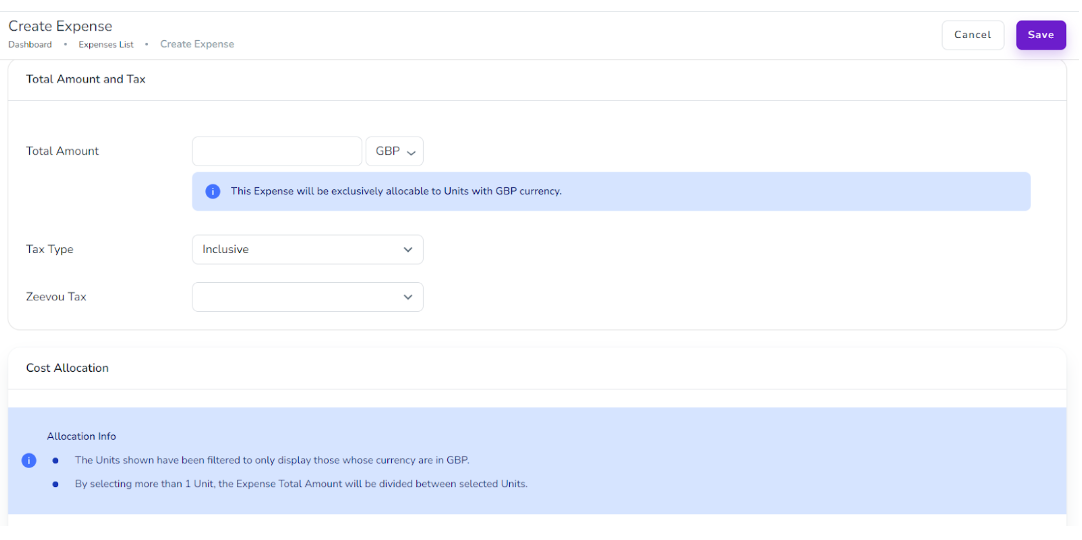

Our vacation rental expense tracking helps you customise expense types, link them to specific accounts, and apply preferred tax codes. Expenses can be allocated at the property, unit, or booking levels. Plus, all expenses in Zeevou are included in Monthly Profit Reports for specified deals, providing owners with detailed insights.

Tailor Every Expense, Enhance Your Reports

Our vacation rental expense tracking helps you customise expense types, link them to specific accounts, and apply preferred tax codes. Expenses can be allocated at the property, unit, or booking levels. Plus, all expenses in Zeevou are included in Monthly Profit Reports for specified deals, providing owners with detailed insights.

Be in Control of Your Finances

Related Features

We understand your challenges...

It is easier to increase your profits by correctly managing your expenses than by slightly increasing your sales. However, for large-scale vacation rental property managers, it can be extremely difficult to keep track of expenses made by various staff on behalf of multiple third-party owners.

Besides having to ensure that no expense goes unallocated, it is also of utmost importance to ensure that every expense is allocated to the correct property. While it is possible to keep on top of income and expenses using third-party accounting software such as Xero, usually these do not allow profits to be calculated fully based on trust accounting, nor do they enable you to allow your owners to track their profits in real time.

How Can Zeevou's Expense Tracking Help?

Not only does Zeevou allow you to keep track of booking-related costs such as OTA commissions, housekeeping costs, or transaction costs, with Zeevou’s Expense Tracking feature you can also log any other type of expense.

The system is highly flexible in allowing you to create custom expense types, associate them with a specific account and apply a tax code of your choice. Moreover, expenses can be allocated at the property level, unit level, or even the booking level. Unit level allocation can be done based on the number of units within a property, or it can be weighted based on how many bookings each unit has in a particular month.

All the expenses added in Zeevou are taken into account in the Monthly Profit Report that is generated for every deal that you specify in the system for an investor. This allows a full profit analysis to be undertaken, enabling you to expand your business based on a thorough understanding of your actual profits rather than booking-related positive cash-flow. At the same time, the access that owners get through the owner portal gives owners that you may be co-hosting for absolute peace of mind that you are fully transparent with them. They can rest assured that you are clearly tracking both the income that is being generated, as well as any expenses that you may incur on their behalf.